Service Category

Transform Your Insurance Workflows

Behind every insurance document lies a customer waiting for an answer. A family anxious about their claim. A business owner eager to secure coverage, policy holder seeking peace of mind. What if you can transform these waiting moments into the winning experiences ?

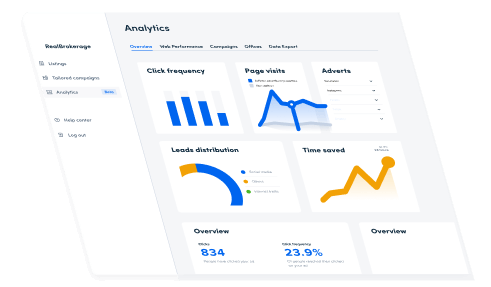

Otolab Intelligent Automation not only handles paperwork, it also accelerates the moments that matter in your customer journey. Processes documents 10x faster, reduces operational cost by 85%, improve accuracy rates by 99.9%, free up staff for higher-value activities and scales operations without adding headcount.

Otolab Automation Capabilities for Insurance Sectors

Multi-source and multi-format Data ingestion and processing:

Otolab supports multi-source retrieval from cloud storage platforms such as Google drive, One Drive, Amazon S3 and messaging platform such as WhatsApp, Telegram and e-mail servers. Also processes multi-format documents which enhances the versatility in document automation workflowEnterprise System Integration Architecture:

Integrates with leading Insurance Management System (IMS), Investment Management Systems(IMS), Policy Management System(PMS) , Claims Processing System(CPS), CRMs and Underwriting Systems facilitating data exchange across multiple platforms.Critical Human review phase:

The human review phase is essential for insurance document processing because it ensures 100% accuracy, compliance and risk mitigation, particularly in scenarios such as- 1. Complex Decision-making in RFPs

- 2. Accuracy and verification in Census Data Processing

- 3. Risk evaluation in underwriting

Bussiness Impact

- Immediate Benefits-Automates upto 85% of manual tasks, reduces errors by 95%, process documents 10x faster, 95% reduction in routine tasks.

- Long-term Value-Customer satisfaction with faster response time, focus on value-added tasks, scalability and innovation.

Top Use Cases that Drives Results

Group insurance policies rely on census data. Otolab extracts and validates the employee demographic data such as age, salary and dependents. Faster processing of large data sets enables quicker premium calculations and policy issuance. This improves accuracy and reduces your administrative costs.

Automating the extraction of client requirements, coverage needs, and specifications from RFPs, helps in faster and more accurate proposal generation. This increases the chances of winning deals and minimizes the costs.

Speed up the review of your underwriting document, allowing the underwriters to focus on the risk evaluation. Underwriting requires review of documents like health records, financial statements and property details to assess risk. Accelerated underwriting documents reduce operational costs and improve policy holder experience.

Streamlines the generation of policy documents by automatically extracting and organizing customer and policy data. Otolab turns time consuming processes such as time taken for the draft, review and finalizing policies into efficient workflows swiftly.

Accelerate your claims management by instantly verifying and processing claims data such as invoices, reports and forms. Reduces claims cycle and overall customer experience.

About Customer Stories

Erma P. Brown

Community Organiser

“This is really awesome. many small businessmen are suffering from this service in different platform and the lovers are always looking this kind of feature on their own website.”

Joann J.

CEO of HXR Theme

“This is really awesome. many small businessmen are suffering from this service in different platform and the lovers are always looking this kind of feature on their own website.”

Steven G.

Director of Rotyu Comunity

“This is really awesome. many small businessmen are suffering from this service in different platform and the lovers are always looking this kind of feature on their own website.”

Gary M. Adams

Chif of UITREE

“This is really awesome. many small businessmen are suffering from this service in different platform and the lovers are always looking this kind of feature on their own website.”